what is suta tax california

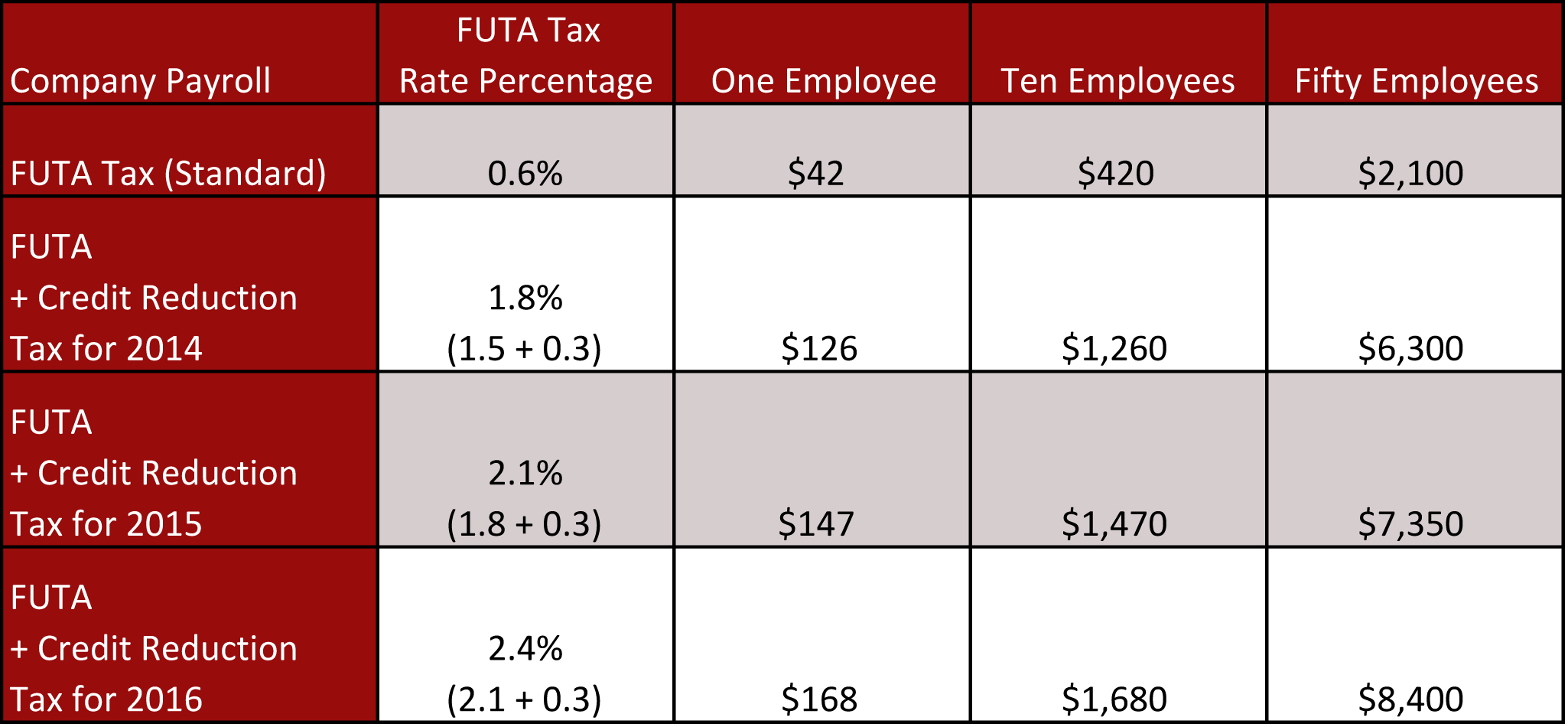

The percentage of the SUTA tax varies from state to state. This means that employers paying wages subject to UI will owe a greater amount of FUTA tax.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

New Hampshire has raised its unemployment tax rates for the second quarter of 2020.

. 52 rows Generally unemployment taxes are employer-only taxes meaning you do not withhold the tax from employee wages. Imagine you own a California business thats been operating for 25 years. California has four state payroll taxes.

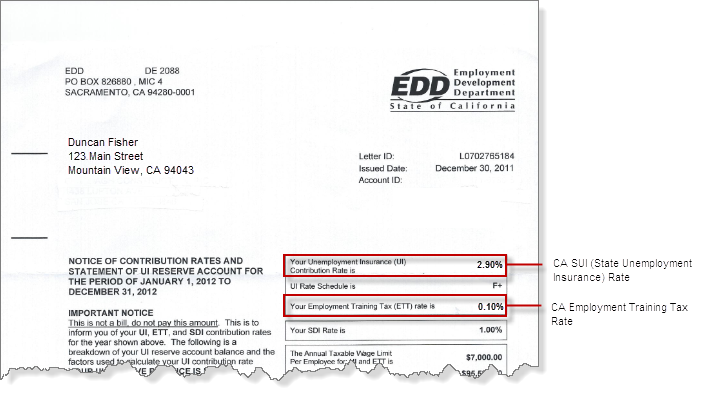

Its important to calculate SUTA taxes in conjunction with the FUTA tax. Employers in California are subject to a SUTA rate between 15 and 62. The rate is 6 of an employees first 7000 in taxable wagesbut it can be credited by up to 54 depending on how much an employer pays in SUI taxes and whether the state repaid any federal loans.

The SDI withholding rate is the same for all employees and is calculated annually. The tax rate for new employers is 17. The SUTA tax is the state version of the FUTA tax.

However it is always a simple percentage of the employees pay up to a yearly earnings limit. Employer Unemployment Insurance UI Tax UI is paid by the employer. The 2020 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

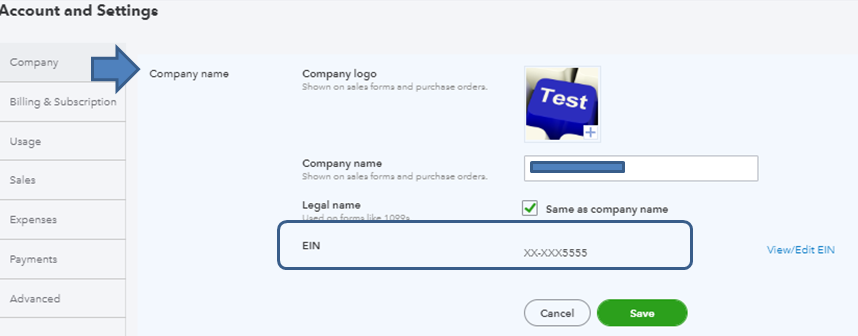

They also pay separate FUTA taxes to the federal government to help pay for the administration of the UI. 52 rows SUTA the State Unemployment Tax Act is the state unemployment. California State Payroll Taxes - Overview.

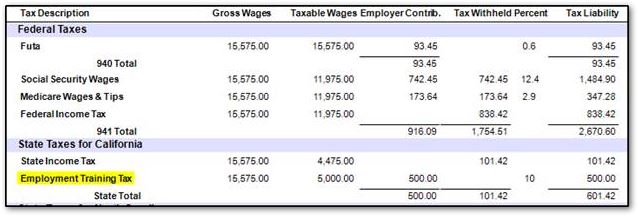

Employers are required to pay both state unemployment payroll taxes SUTA and federal unemployment payroll taxes FUTA. State Disability Insurance SDI and Personal Income Tax PIT are withheld from employees wages. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state.

Experienced sky-high unemployment rates. Like SUTA wage bases SUTA rates also vary state to state. The maximum to withhold for each employee is 160160.

Tax rates for the second quarter range from 01 to 17 for positive-rated employers and from 33 to 75 for negative-rated employers. The SUTA program was developed in each state in 1939 during the Great Depression when the US. SUTA was established to provide unemployment benefits to displaced workers.

California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. Federal Unemployment Tax Act FUTA FUTA Information for Wages Employers Paid in 2021. The UI rate schedule and amount of taxable wages are determined annually.

The SUI taxable wage base for 2020 remains at 7000 per employee. You cannot protest an SDI rate. Just as FUTA taxes fund federal unemployment programs SUTA taxes fund your states unemployment insurance program.

California does have an outstanding loan balance as of January 1 2021 so future. In California in recent years it has been somewhere around 34. 2020 SUI tax rates and taxable wage base.

The SDI withholding rate for 2022 is 110 percent. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. The state UI tax rate for new employers known in some states and federally as the standard beginning tax rate also can change from one year to the next.

State unemployment tax is a percentage of an employees. Who pays Suta in California. SUI tax aka SUTA tax and FUTA tax are both unemployment-related payroll taxes.

The SDI withholding rate for 2022 is 110 percent. The taxable wage limit is 145600 for each employee per calendar year. What is California tax rate for payroll.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content. A new employers rate usually will remain the same for at least the first two or three years. Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year.

This new law effective January 1 2005 provides for employers who are caught illegally lowering their UI rates to pay at the highest rate provided by law plus an additional 2 percent. What is California tax rate for payroll. The new employer SUI tax rate remains at 34 for 2020.

The new employer SUI tax rate remains at 34 for 2021. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. For the majority of states SUTA tax is an employer-only tax.

Taxes under State Unemployment Tax Act SUTA are those designed to finance the cost of state unemployment insurance benefits in the United States which make up all of unemployment insurance expenditures in normal times and the majority of unemployment insurance expenditures during downturns with the remainder paid in part by the. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base. SUTA or the The State Unemployment Tax Act SUTA is a payroll tax paid by all employers at the state level.

California employers fund regular Unemployment Insurance UI benefits through contributions to the states UI Trust Fund on behalf of each employee. Current federal law provides employers with a 54 percent FUTA tax credit and no FUTA tax credit reduction will occur in 2022 for wages paid to their workers in 2021. SUTA was established to provide unemployment benefits to displaced workers.

As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to include a 15 surcharge. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Contribution Rates For 2011 2012 and 2013 the ranges of Ohio unemployment tax.

States use funds from SUTA tax to pay unemployment benefits to unemployed workers. Most employers are tax-rated employers and pay UI taxes. However some states Alaska New Jersey and Pennsylvania require that you withhold additional money from employee wages for state unemployment taxes SUTA tax.

AB 664 - With the passage of AB 664 California became one of the first states in the nation to enact legislation as a result of the federal SUTA Dumping Prevention Act. In 2018 the trust fund regained a positive balance after nine years of insolvency. FUTA is the tax paid by the employer at the federal level.

As with almost all state regulations the rules that company. See more information here. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F.

What Is Sui State Unemployment Insurance Tax Ask Gusto

The True Cost Of Hiring An Employee In California Hiring True Cost California

Futa Federal Unemployment Tax Act San Francisco California

2.jpg)

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability

4.jpg)

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability

How To Update Suta And Ett Rates For California Edd In Qbo Youtube

What Is Sui State Unemployment Insurance Tax Ask Gusto

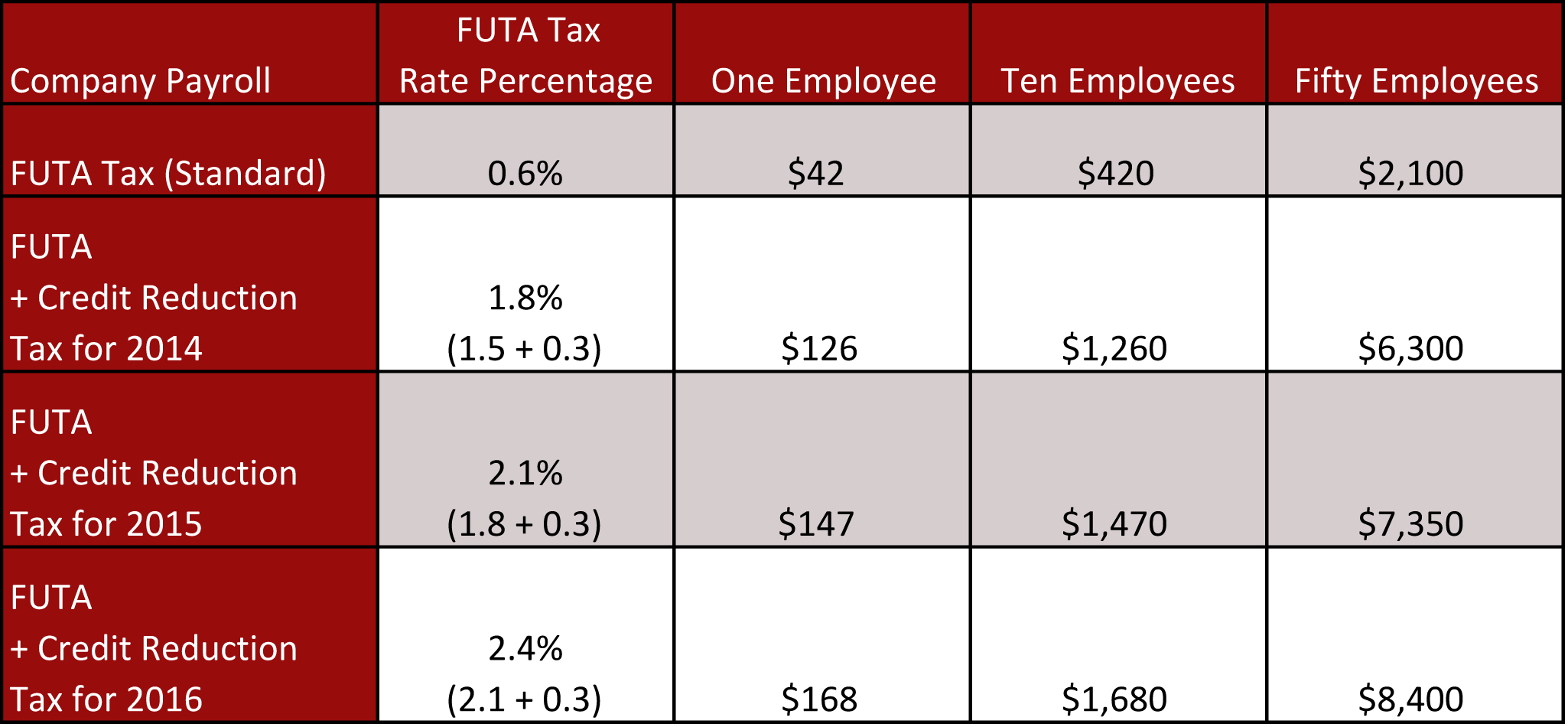

Does Quickbooks Automatically Adjust Employer Payroll Tax Rates At The Beginning Of A New Year Newqbo Com

How Do I Get My California Employer Account Number

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer

Ca Employment Training Tax Das

1.jpg)

Ca Sdi Deduction Das Drake Accounting How Do I Set Up The Ca Sdi Deduction Summary Of California State Disability Insurance Sdi Setup Confirm That Your Client S State Is Ca Set The Appropriate Ca Rates And Limits For Unemployment And Disability

State Unemployment Insurance Sui Overview

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor